Photo courtesy of SkintDad.co.uk licensed under CC BY-NC 2.0

The surge in financial struggles during COVID

The holidays welcomed another surge in the pandemic, further stressing the importance of remaining quarantined to help prevent the spread. In turn, financial struggles among families have continued to increase.

Unemployment has been on the rise, induced by a surge in COVID-19 cases and leaving many families without a steady source of income. Yet, the responsibilities of paying for housing, food, and other necessities have remained unchanged, burdening individuals with more and more debt. In a time of such crisis, people are not seeing much financial relief, even prompting students to take on part-time jobs to provide for their families to survive the year.

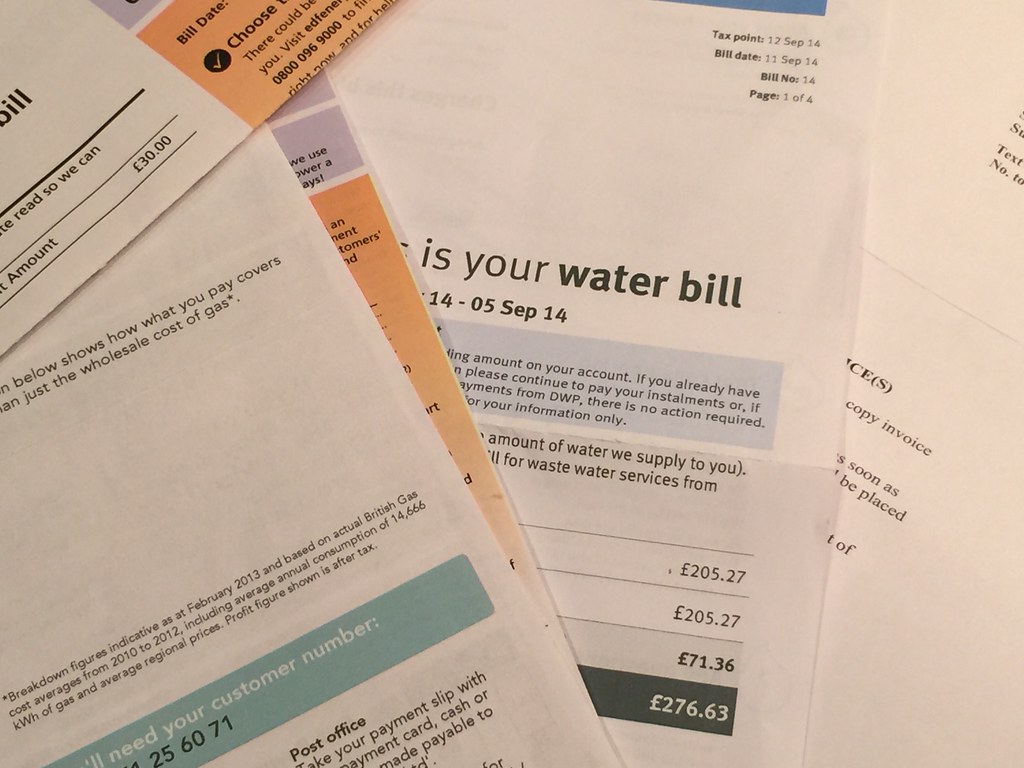

As people continue to quarantine, utility bills are exceeding average costs. Due to frequently spending time at home and changes in the weather, individuals are using more central air to heat or cool their surroundings. The cost of utility bills is currently up 34% compared to previous years, not including the abundant amount of necessities that need to be bought overall. As a result of this, individuals will struggle to pay off expensive bills.

With indoor dining widely prohibited, ordering takeout or delivery from restaurants has been encouraged for quarantine; however, it is extremely pricey. Since Proposition 22 was passed in November, Uber, Lyft, DoorDash, Instacart, and Postmates drivers accept increasing benefits from their labor. This means that drivers will earn more than they previously have for every order, making online orders more expensive for consumers. With other additional bills and essentials, individuals are prone to be financially unstable.