dav

College does not have to break your bank

By Tiffany Nguygen & Melody Zhang

Money is an issue that factors heavily into a student’s college decisions. While there are many colleges to choose from, the fear of student debt can limit one’s options.

A college education is now more expensive than ever, and the money required to attend a four-year public institution in 2017-18 increased by a staggering 123 percent since 1997-98, according to a report by the College Board. Besides the required tuition, living and boarding expenses are the next highest in what students have to pay for, and they are obligated to dorm for a certain amount of time at most colleges.

With the monetary requirements of being a college student, high school students need to start planning how they can reduce future student debt as soon as they can. Students have a variety of options when it comes to earning or saving money for their college education.

“Go for any scholarships you can apply for, even if it’s just a small amount like $500 or $1,000; [it] all helps,” history teacher Henry Osborne said.

Throughout their high school career, students can work during the summer or while they are attending classes. Another alternative is to seek financial aid by filling out The Free Application for Federal Student Aid form.

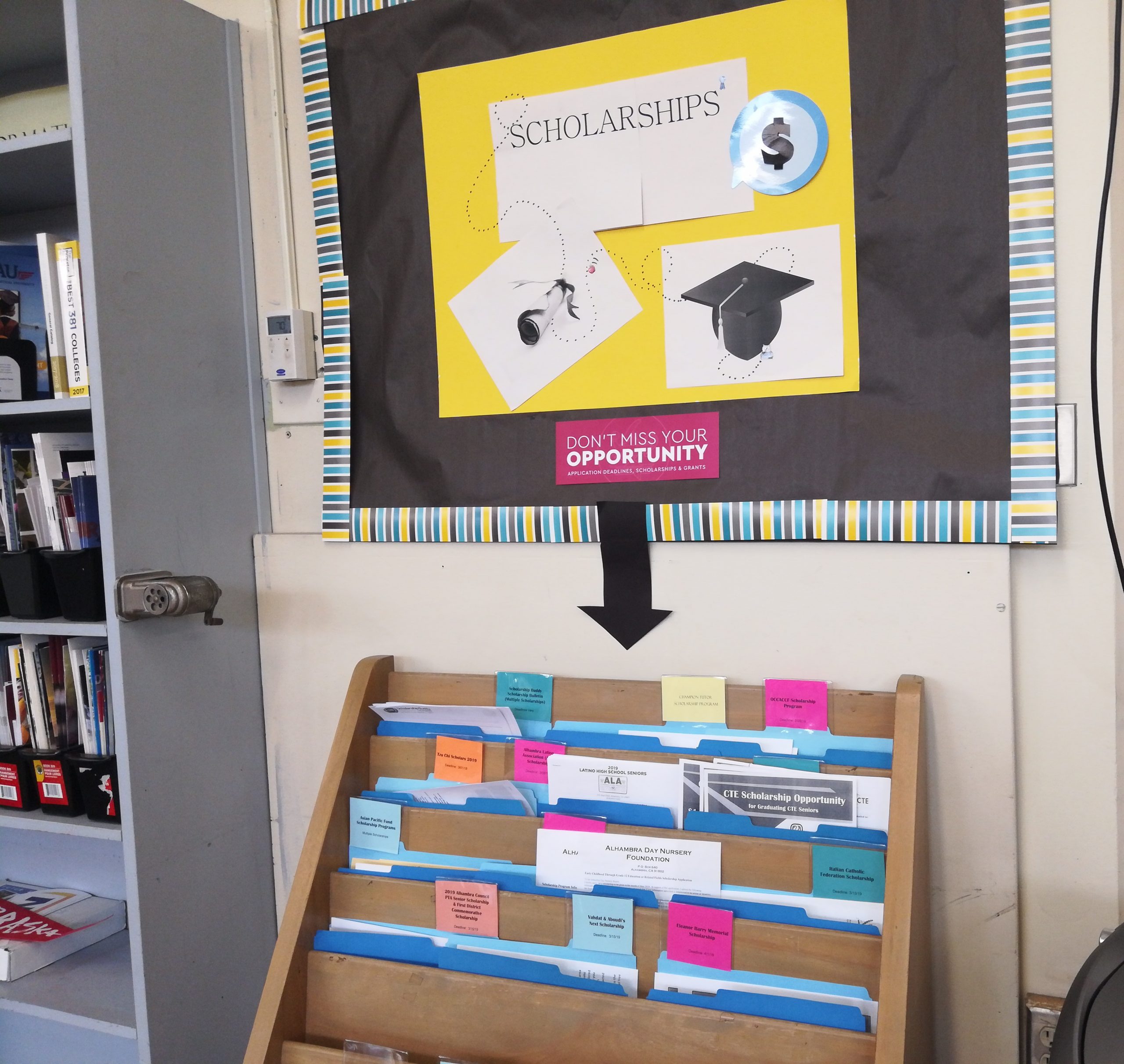

Facilities on campus such as the College and Career Center (CCC) and the website run by the CCC staff provide multiple opportunities for scholarships, information about colleges, job applications for minors, and other tools to help them prepare for college. Students can also receive messages about college-related events and resources through the Remind application by texting @sghsccc to 81010.

“That’s where I send the flyers for everything,” Career Technical Education adviser Paulina Diaz Serrano said. “So students can connect through text or email, or [by downloading] the app.”

Another way to save money and reduce debt is to go to a community college for the first two years. Upon reaching the required credits, students can transfer to a higher level college, which is a cheaper option than going directly to a four-year university. Students can also take advantage of the reduced or free tuition of local community colleges, such as East Los Angeles College or Pasadena City College, that is offered to those within close proximity to the schools.

Students can also strategize for their graduate degrees by saving more money for their post-bachelor’s degree, such as a master’s, doctorate, or Ph.D., which are usually more expensive.

“If you spend all of your money getting your bachelor’s degree, you will have no extra money left over when you [do] your post-bachelor’s degree,” Osborne said. “Whereas if you go [for] a cheaper option you might have some money left over, so you won’t be in debt for your master’s degree.”

Saving up enough money for college can be achieved through budgeting and careful spending. Some actions that can be taken now include keeping track of how much money is used and the cash one earns throughout a certain period of time. Applications such as Mint, Money Manager, and others can aid in tracking finances. A journal or Google Drive program can also do the same.

“It’s not just about taking out debt, it’s about how you spend [money],” English teacher Virginia Parra said. “Learning how to budget and being conscious about your money really does help.”